New Proof of Loss Requirement, Pre-Suit Notice, and Attorney’s Fees Provisions

A client recently provided us with a renewal policy she received from Olympus Insurance Company for 2020-2021. After reviewing the “Notice of Change in Policy Terms,” we note several new changes to policy provisions.

1. Proof of Loss Requirement

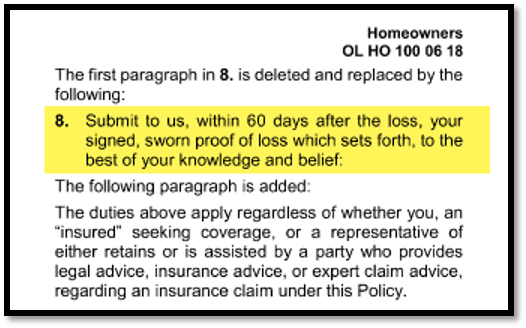

Most policies generally require an insured to submit a signed, sworn proof of loss within 60-days of the insurer’s request. The new Olympus policy language now requires an insured to submit a signed, sworn proof of loss within 60 days after the loss. The revised policy provision states, in relevant part, as follows:

B. Duties After Loss

…

8. Submit to us, within 60 days after the loss, your signed, sworn proof of loss which sets forth, to the best of your knowledge and belief:

The duties above apply regardless of whether you, an “insured” seeking coverage, or a representative of either retains or is assisted by a party who provides legal advice, insurance advice, or expert claim advice, regarding an insurance claim under this Policy.

This provision is troubling for several reasons: First, many insureds will simply be unaware of this new requirement or will not understand if/how it applies to them. Instead of requesting a proof of loss (which would confirm that insureds are aware of the requirement), Olympus has snuck in this requirement knowing that many insureds may overlook and/or be confused by this requirement.

Second, if an insured does not comply with this “hidden” requirement, Olympus will likely use this “failure to comply” with the policy’s “Duties After Loss” as a basis for claim denial.

Third, the new language is also problematic because it requests a proof of loss within 60 days after the loss occurs. But what about instances where insureds do not immediately discover damages? For example, what happens when a July windstorm causes damage to the roof of an insured property but the insureds are unaware of the damage until leaking occurs months later? Will Olympus take the position that the claim is barred because a proof of loss was not provided within 60 days of the July windstorm?

2. Pre-Suit Notice Requirement

Another change is found in the “Suit Against Us” provision. Specifically, the policy now requires the foregoing:

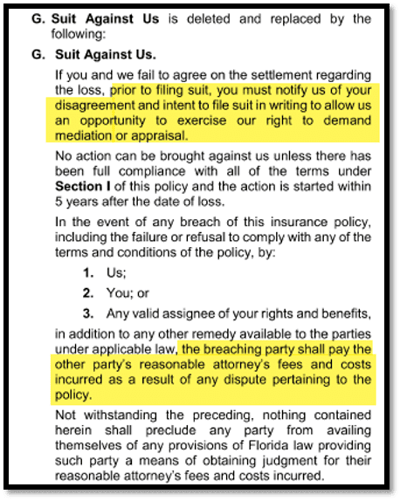

G. Suit Against Us.

If you and we fail to agree on the settlement regarding the loss, prior to filing suit, you must notify us of your disagreement and intent to file suit in writing to allow us an opportunity to exercise our right to demand mediation or appraisal.

No action can be brought against us unless there has been full compliance with all of the terms under Section I of this policy and the action is started within 5 years after the date of loss.

This new provision requires insureds to specifically advise Olympus in writing that they intend to file suit. Again, many insureds may overlook and/or not understand this provision. This provision is also contrary to well-established Florida law holding that “[w]hen a nonbreaching party to a contract is confronted with a breach by the other party, the nonbreaching party may stop performance, treating the breach as a discharge of its contractual liability.” Toyota Tsusho Am., Inc. v. Crittenden, 732 So. 2d 472, 477 (Fla. 5th DCA 1999). Similarly, Florida case law indicates that an insured may file suit when their claim is denied. Olympus is attempting to contract around Florida Law. This is yet another “hidden” requirement that Olympus has snuck into its policy that it will undoubtedly try to use to insulate itself from lawsuits and otherwise limit its insureds’ access to courts.

Olympus purportedly includes this requirement so that it can have the “opportunity” to demand mediation or appraisal. However, appraisal is not a substitute for proper claim adjustment. Moreover, appraisal will result in a lower recovery to its insureds as they are required to pay for their appraiser (as well as half the cost of the umpire, if necessary). Insureds often face significant delay in the appraisal process.

3. Attorney’s Fees Provision

The “Suit Against Us” provision also contains a new provision regarding attorney’s fees:

In the event of any breach of this insurance policy, including the failure or refusal to comply with any of the terms and conditions of the policy, by:

1. Us;

2. You; or

3. Any valid assigned of your rights and benefits,

in addition to any other remedy available to the parties under applicable law, the breaching party shall pay the other party’s reasonable attorney’s fees and costs incurred as a result of any dispute pertaining to the policy.

Notwithstanding the preceding, nothing contained herein shall preclude any party from availing themselves of any provisions of Florida law providing such party a means of obtaining judgment for their reasonable attorney’s fees and costs incurred.

This attorney’s fee provision attempts to limit litigation by threatening and/or penalizing insureds who “dare” to file suit in order to recover wrongfully withheld or denied benefits. Florida law (specifically § 627.428, Fla. Stat.) already provides for attorney’s fees to insureds who prevail after having to sue their insurers for underpaid or denied claims. This fee provision is designed to create a two-way fee provision to benefit Olympus to the detriment of its insureds without changes to Florida Statutes.

This attorney’s fee provision attempts to limit litigation by threatening and/or penalizing insureds who “dare” to file suit in order to recover wrongfully withheld or denied benefits. Florida law (specifically § 627.428, Fla. Stat.) already provides for attorney’s fees to insureds who prevail after having to sue their insurers for underpaid or denied claims. This fee provision is designed to create a two-way fee provision to benefit Olympus to the detriment of its insureds without changes to Florida Statutes.

Review Your Policy Carefully

Even though the foregoing provisions are from an Olympus policy, it is likely just a matter of time until other insurers incorporate these changes into their own policies. Make no mistake, these changes are devised by the insurance companies to protect their own interests, to limit its insureds’ access to courts, and to slowly chip away at the rights and recovery of its policyholders.

The starting point for any claim is a thorough review of the terms and conditions of your insurance policy. If you have any questions regarding your insurance policy provisions or your rights in the claims process, contact one of our expert insurance claims attorneys at Murray + Murray today at 1-855-269-4317. We are here to help.

%20LOGO%20FINAL.png?width=1089&height=252&name=MLG%20(PREMIUM)%20LOGO%20FINAL.png)