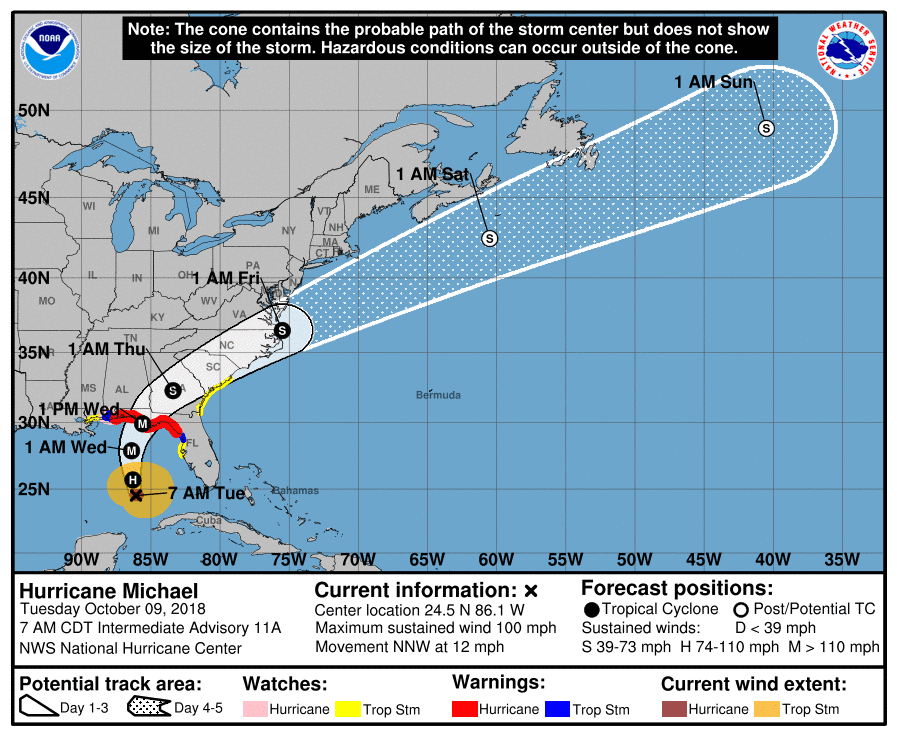

Recent forecasts indicate that Hurricane Michael may be a major category 3 storm when it makes landfall. This means that winds from 111 to 129 mph could strike areas of the Florida Panhandle and Big Bend region. Governor Rick Scott has declared a state of emergency. This post will explore how you can prepare for the storm, stay safe, and pursue a successful insurance claim if your home or business property is damaged by the storm.

Have an Evacuation Plan

Many Florida towns and cities have evacuation routes in place to use in case of a major hurricane, but it is up to you to make sure you have the items you need as you evacuate. This includes medicines, personal devices (and portable chargers), flashlights, radios, water, and other essential items. It is also important that you have irreplaceable items like birth certificates, wills, deeds, and your insurance policies (many of which can now be stored digitally).

It is also important that you and your loved ones create a system to verify each other’s safety if you are separated. With texting, apps, and social media check-in functions, this is easier to accomplish for families and business than ever before.

Protect Your Home and Business

Nothing can “hurricane-proof” your home in the event of a severe storm, but there are measures you can take to reduce the damages. If you do not have storm shutters, invest in plywood as it can help avoid broken windows and interior damage to your home. Confirm that all doors are dead-bolted and locked when the storm hits. Remove outdoor furniture from your yard as well as any other items that could become “flying” dangers. Seal and protect any exposed outlets, ducts, and vents. Additionally, many cities and counties have sandbag stations where residents can fill sandbags to protect against water intrusion.

Create a Household and/or Business Inventories

In the aftermath of a major storm, you will need to be able to identify any damaged contents items. Creating an inventory of home or business contents will help ensure any storm damage claim is as thorough as possible. In addition to taking digital photographs of the contents, consider videotaping the interior and exterior of your home or business so you will have a clear “before and after” record of the condition of your property.

After the Storm

After a storm passes and your friends and family have been safely accounted for, it is crucial that you assess your home or business in order to identify damage and timely report the loss to your insurance company. It is also important to thoroughly document any damage and mitigate any further damage to the extent possible.

Making a storm damage claim can be complex and it is possible (and oftentimes too common) that you will face resistance from your insurance company. Your insurance policy requires you comply with certain conditions and duties in order to receive payment for your damages. This includes providing your insurance company prompt notice of the loss.

If you have questions about the insurance claim process, questions about the terms of your insurance policy, or questions about whether you are being treated fairly and paid fully, it is time to speak to a lawyer at Murray + Murray. There is no charge and no obligation.

At Murray + Murray, our proven property insurance law attorneys understand- the challenges insureds face in the aftermath of a catastrophe like Hurricane Michael. We have helped thousands of Florida Insureds with their hurricane claims and other property losses. Murray & Murray is committed to helping our clients recover all insurance benefits owed to them. Consultations are always free.

%20LOGO%20FINAL.png?width=1089&height=252&name=MLG%20(PREMIUM)%20LOGO%20FINAL.png)