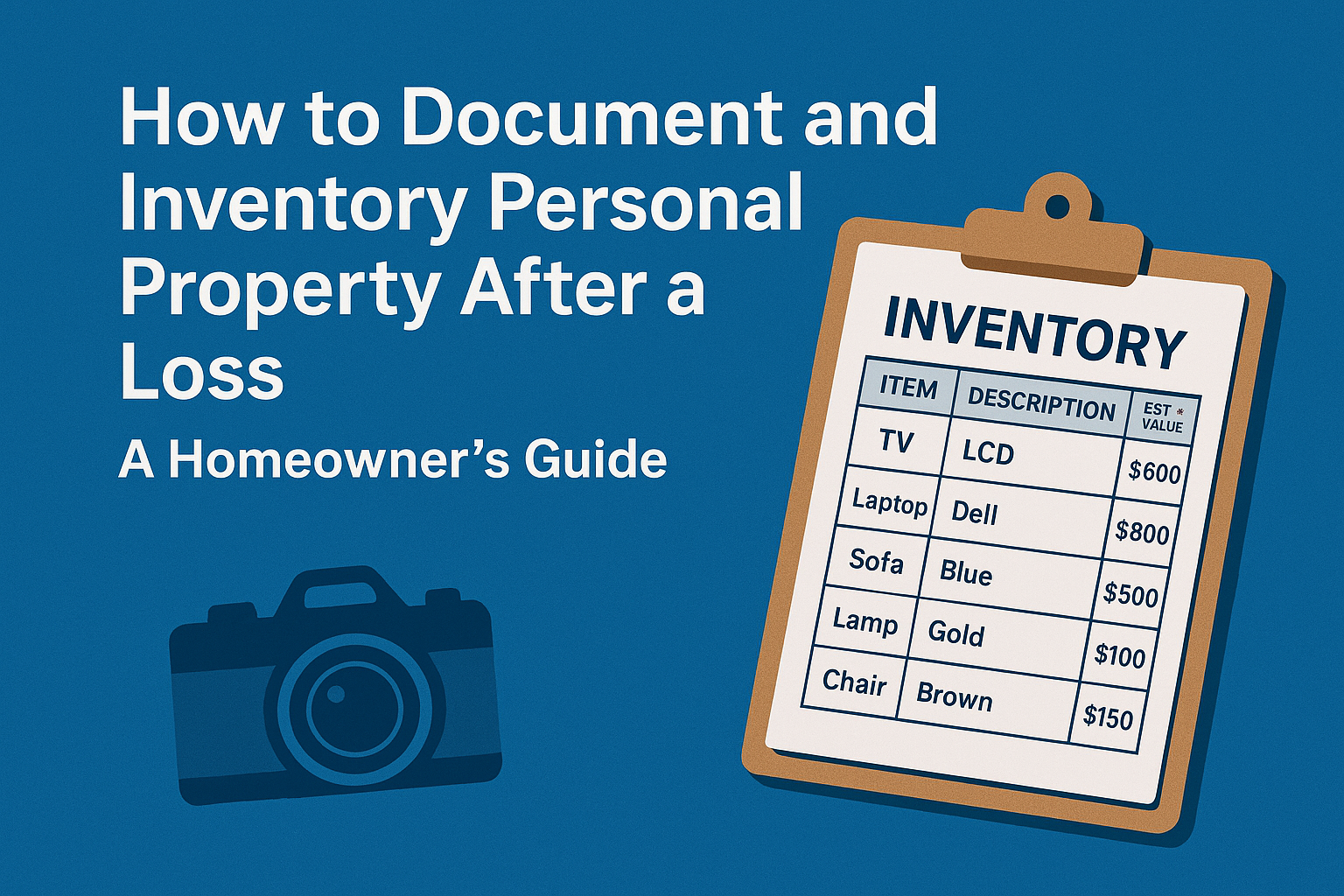

When disaster strikes your home, one of the most important steps you can take to protect your insurance claim is properly documenting your personal property. Your insurance company will require that you prepare a Personal Property Inventory to document your damages. A Personal Property Inventory, like the sample here, can seem overwhelming. Most of us don’t have a perfect home inventory tucked away before disaster strikes; and that’s okay. I understand firsthand how overwhelming it is to go through an insurance loss while trying to piece together what you owned. But there are ways to prepare for the worst. By preparing ahead and being diligent after a loss, you place yourself in the best position to recover the full value of your personal property under your policy.

Preparing for Hurricane Season

While you are preparing for the hurricane season, think about your personal property. Before a loss occurs, take time to photograph or video your rooms, opening drawers, and capturing serial numbers on electronics and appliances. Keep receipts, invoices, or even credit card statements that prove purchase dates and values. Storing these records digitally, on a cloud service or external hard drive, can make them easily accessible when you need them most. Many of us buy things online like Amazon, Target, and other retailers that keep detailed purchase histories you can access. Your bank and credit card records are also great tools to confirm what you paid and when. If receipts truly aren’t available, look for old product manuals, warranty cards, or even photos of you and your family using the item. All of these things can help establish ownership and value.

When your world is upside down, the last thing you want to do is sort receipts and make lists. But the more you can document, the smoother your recovery will be. After a loss, prompt and thorough documentation becomes even more critical. Take photos or video of the damaged rooms and items where they sit. Open drawers, cabinets, and closets, and capture multiple angles. Be sure to capture multiple angles that clearly show the extent of the damage.

If the item is repairable, preserve it until your insurance company has had an opportunity to inspect. Even if something feels like trash now, try to hold onto it until the insurance company has had the chance to see it. Do not throw away damaged items unless absolutely necessary for safety reasons. If you must dispose of something, document it carefully first. This evidence helps prevent disputes later about what was lost or how badly it was damaged.

Finally, when estimating replacement prices, check online for what similar items cost today. Screenshots of product pages or store listings can serve as evidence for your claim. The goal isn’t perfection. The goal is to create as complete a picture as you reasonably can under difficult circumstances. The stronger your documentation, the harder it is for an insurance company to undervalue or deny your claim. Preparing ahead and being diligent after a loss can make a real difference in recovering the true value of what you have lost.

Steps to Document and Inventory Personal Property

- Take Photos & Videos

- Photograph each room, including inside drawers, cabinets, and closets.

- Capture multiple angles of each item.

- Record serial numbers on electronics and appliances.

- Preserve Damaged Items

- Keep damaged property until the insurance company inspects it.

- If you must dispose of something for safety, document it thoroughly first.

- Gather Proof of Ownership

- Collect receipts, invoices, or appraisals where available.

- Check online purchase histories (Amazon, Target, Walmart, etc.).

- Review bank or credit card statements for purchase details.

- Use product manuals, warranty cards, or family photos as supporting proof.

- Establish Replacement Values

- Search online retailers for current replacement costs.

- Save or screenshot product pages for your records.

- Store & Back Up Your Records

- Save copies of your inventory in both digital and physical form.

- Use cloud storage or an external hard drive for safekeeping.

%20LOGO%20FINAL.png?width=1089&height=252&name=MLG%20(PREMIUM)%20LOGO%20FINAL.png)